New 1099 Rules 2024 – The IRS wants to crack down on third-party payment reporting and was initially planning to require these platforms to issue a 1099 form to anyone of its new reporting rule to make the process . Millions of taxpayers who generate income via online platforms may be receiving Form 1099-K for the first time. .

New 1099 Rules 2024

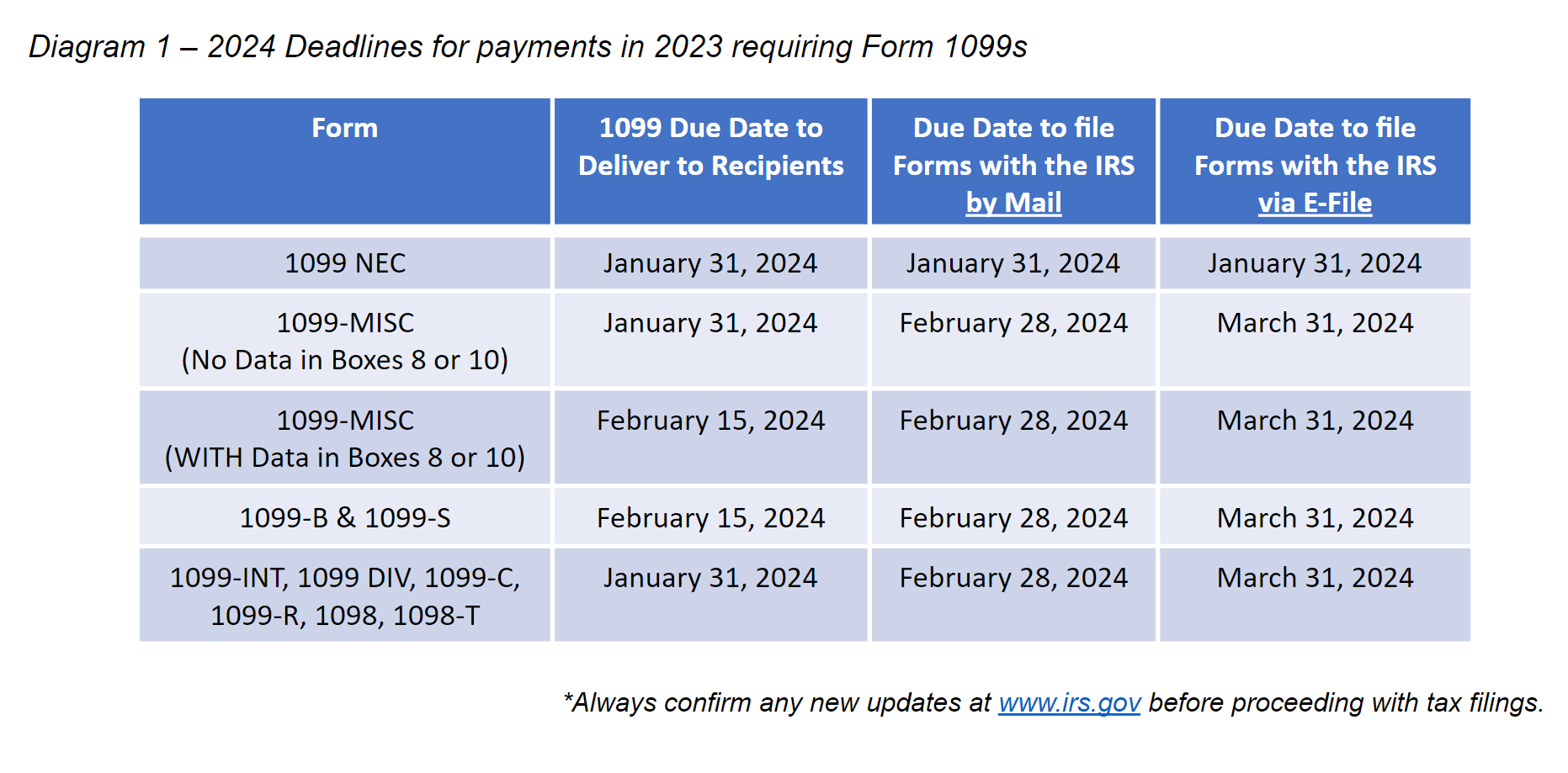

Source : markjkohler.comBlog Series: Tax Law Changes & Updates for 2023 PPL CPA

Source : www.pplcpa.comIRS delays 1099 K rules for side hustles, ticket resales

Source : www.usatoday.com1099 Rules for Business Owners in 2024 Mark J. Kohler

Source : markjkohler.com1099 Rules Business Owners Should Know in 2024

Source : tipalti.comIRS delays 1099 K rules for side hustles, ticket resales

Source : www.usatoday.comTax law changes you need to know for 2024 Avalara

Source : www.avalara.com1099 Rules Business Owners Should Know in 2024

Source : tipalti.comHow Did Your 1099 Season Go? New E Filing Rules Challenged Some in

Source : www.cpapracticeadvisor.com1099 Rules for Business Owners in 2024 Mark J. Kohler

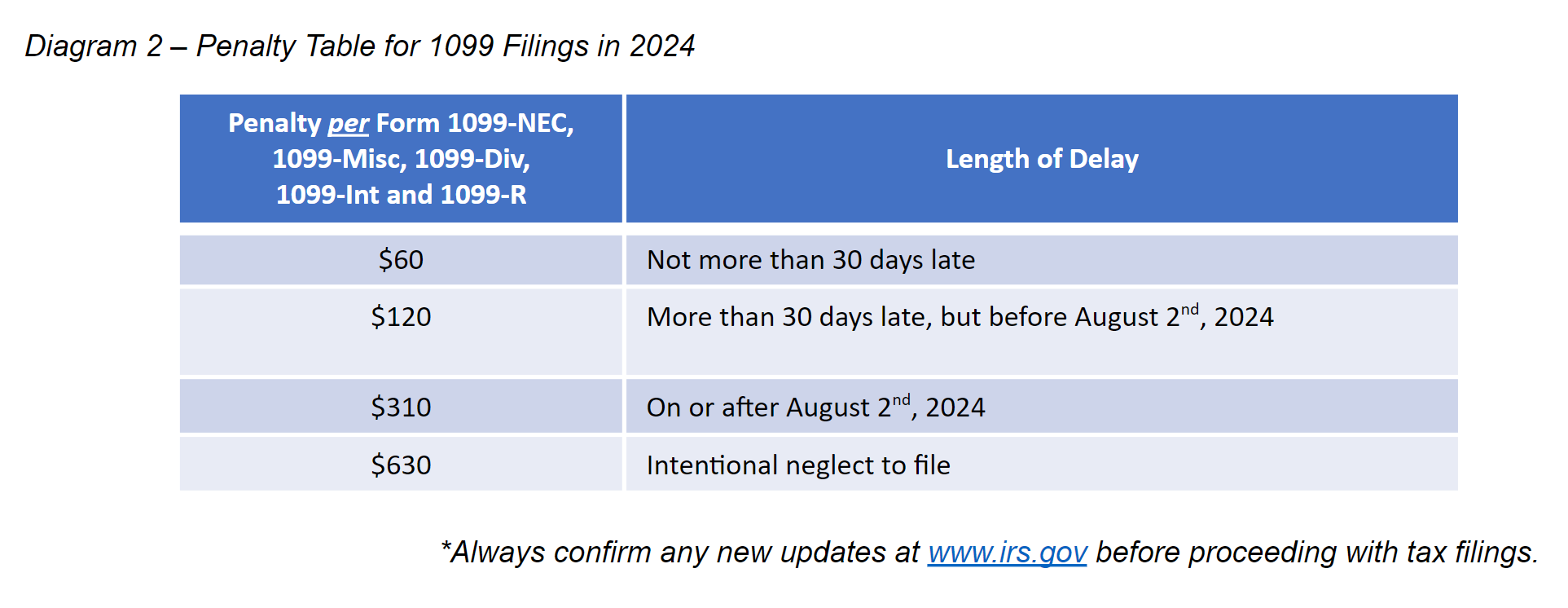

Source : markjkohler.comNew 1099 Rules 2024 1099 Rules for Business Owners in 2024 Mark J. Kohler: If you’re one of the growing number of independent contractors, retirement planning can sometimes seem daunting given the lack of access to a traditional retirement account like a 401 (k). Fortunately . Tax season is in full swing. If you’re waiting on a 1099-K to file your tax return — you may not be getting one. Since the IRS has delayed launching its new 1099-K reporting requirement, .

]]>